All models are wrong, but some are useful. -George Box

All models are wrong, but some are useful. -George Box

George Box, a preeminent statistician, points out that a statistical model is never going to tell you the whole truth and that the usefulness of advanced statistics is based on whether we are asking the correct questions. However, PR often leans on advanced statistics/predictive analytics to provide precise answers to some of the hardest questions facing the industry, many of which revolve around the following questions:

“What is the exact value of PR?” or “What is the business impact of a specific campaign?”

While the industry can and should leverage advanced analytics to answer these questions, it is important to understand that this type of modeling has limits: its role is not to provide unquestioned precise answers, but to provide better information in order to make smarter decisions.

One of the biggest challenges in demonstrating the value of PR is the fact that its goals can be multifaceted. Is the goal about sales, building awareness of a new product, building long-term reputational equity, or crisis-management? The multitude of uses of PR makes a one-size-fits-all approach to KPIs almost impossible. Fortunately, measurement of PR campaigns and tactics will go a long way in being able to answer questions of value and impact, and even allow for optimizing impact in the future.

To help our clients answer these types of questions we often leverage the measurement data that we are already collecting for them. For many of our clients we collect a rich amount of data across paid, earned, shared and owned channels (PESO) that help us demonstrate the worth of PR and counsel them on how to optimize their efforts. Below are two examples of how we linked a healthcare client’s communications output directly to patient volume and stock price.

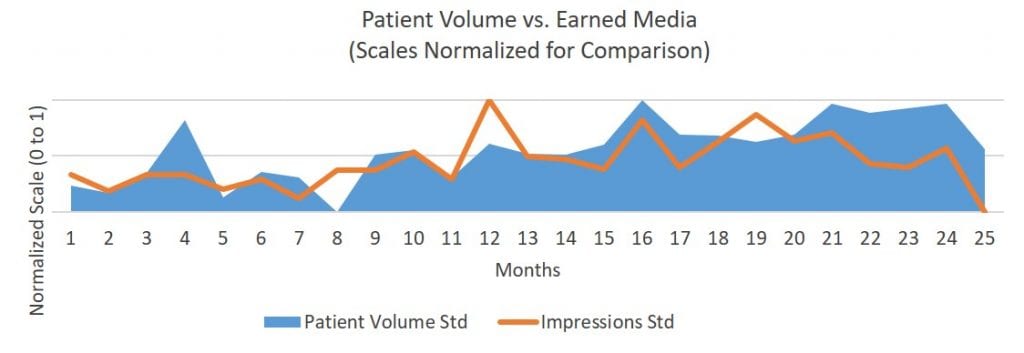

Connecting Earned Media to Patient Volume:

A leading healthcare provider wanted to better understand how earned media affects getting patients in the door. If you just simply chart patient volume against earned media impressions it is easy to see the relationship: when earned media impressions increase so does patient volume. When earned media decreases so does patient volume.

However, this does not necessarily mean that earned media is causing movements in patient volume! It could be that by pure luck, both patient volume and earned media outputs share the same predictable seasonal pattern. To establish a causal link, we developed a model that considers other factors that could possibly cause changes in the healthcare proivder’s patient volume, including its communications across PESO, seasonality, the economy, and consumer confidence (consumers potentially consume more or less healthcare depending on the economy). After we plugged the data into the model, we found that earned media is indeed driving patients to the healthcare provider and we identified the most impactful channels to enhance the communications strategy.

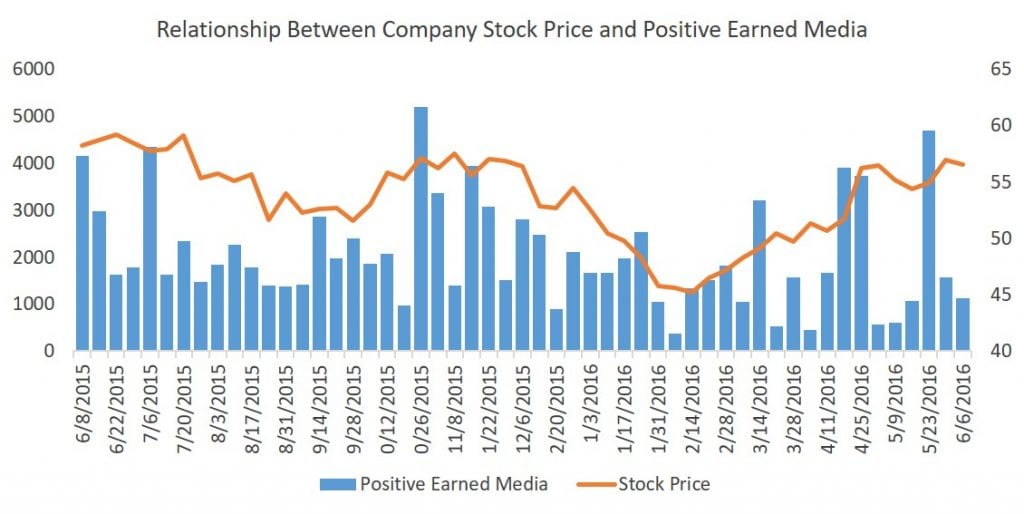

Connecting Earned Media to Stock Price:

The example above showcases an ideal situation because we had access to almost any data we requested, however this is not always or usually the case. Data silos are a major barrier to providing smarter data analysis to clients. In PR, our clients are often CCOs or CMOs who may not have access to, or be able to share, direct business results, which is a major problem if their CEO is asking for the business impact of a campaign or communications function in general. If this is the case, you need to get creative to get around this barrier. An option is to buy estimated sales/revenue data from syndicated sources, but this is often cost prohibitive. A more cost effective option for a publicly traded company is to link communications output to stock price.

A client from a large financial services company wanted to demonstrate to senior leadership how communications was improving the bottom line for the company. They knew that sales/transaction data existed, albeit siloed within another department, so the solution was to show how earned media impacts the company’s stock price. As with the healthcare example, we have found that when you simply graph earned media and stock price together the relationship is real.

But, as with the previous example, communications vitality is not the only thing affecting stock price. There are many factors that can affect stock price, including (but certainly not limited to) competitor activity, seasonality, economic health, consumer sentiment, and even the weather. Therefore, we created a robust model that controlled for all of this and still found that positive earned media did indeed drive stock price. Interestingly, the models demonstrated how social media and traditional earned media interacted to amplify the effect communications had on stock price. Furthermore, we identified story types/messages that are most likely to drive stock price up or down, which allowed the client to understand how different messaging could affect stock performance. This type of information could be invaluable to minimizing risk in a crisis.

Behind these examples is smart measurement, and this type of work would not have been possible without the ability to combine measurement data with other data sources. The results from these two examples did not give our clients a precise roadmap whereby if they said this on this channel with this messenger then their patient volume or stock price will go up by a given amount. However, what it does allow for is the ability to glimpse into a possible future situation that will help you to make smarter bets and improve your chances of achieving your goals: “Given the data we have, these are the options that are most likely going to be successful.”